A person or company arranges a guarantee of compensation when there are specific losses, illness, damage and even death by paying a specified premium. This is called Insurance.

Insurance can also be referred to as a contract which is represented by a policy. Here, a company, an individual or entity receives protection financially or in most cases, reimbursement against certain losses from an Insurance company.

There are different types of insurance such as Life, Health, Car, Home, Long-term care, Liability, Disability, etc.

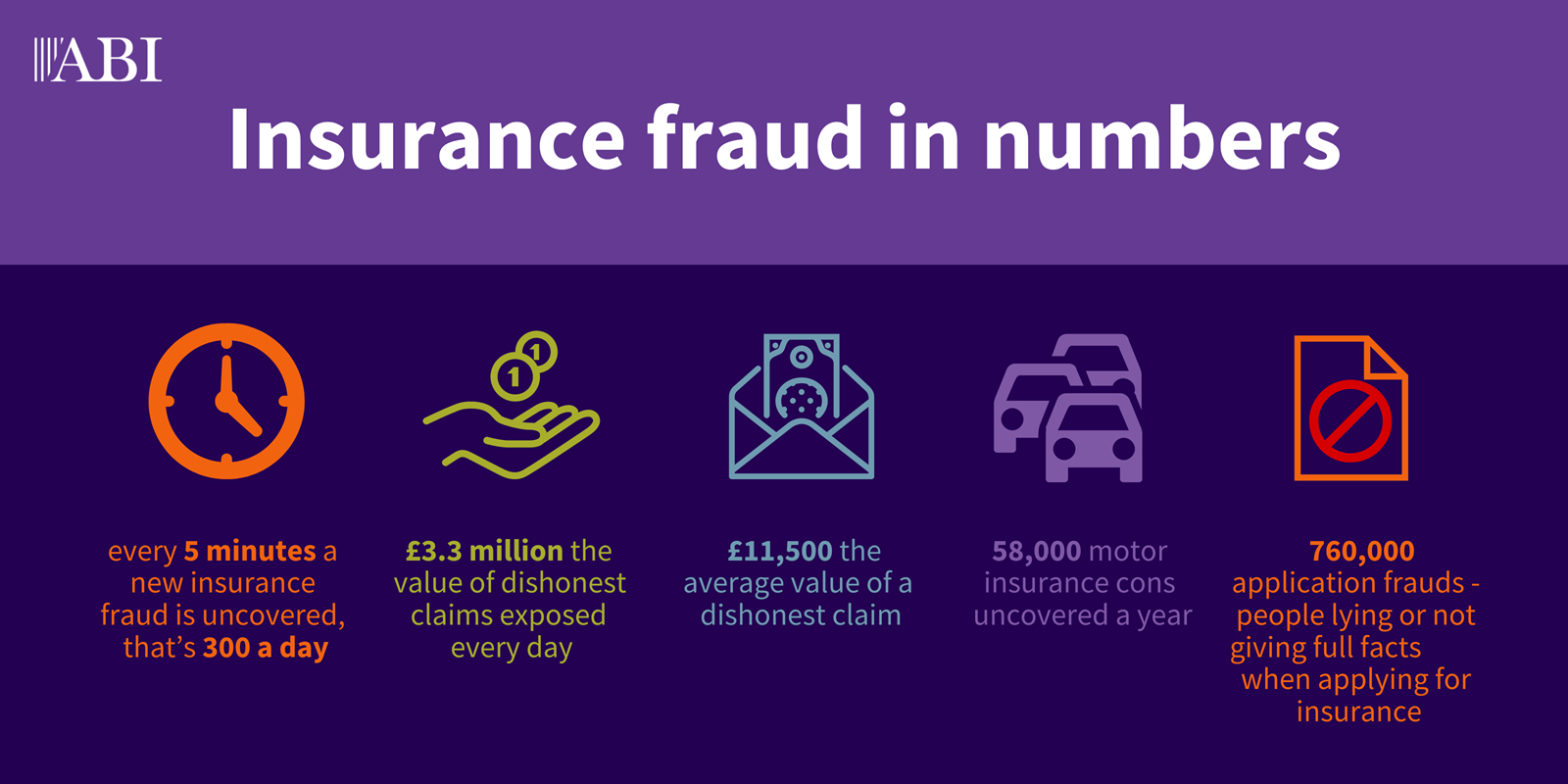

Insurance fraud is an act committed to defraud an insurance process. Perpetrators of insurance fraud try to take advantage of situations that never happened or are exaggerated to obtain benefits they are not entitled to. Often, the perpetrators of insurance fraud see insurance as a vehicle to enrich the insured as opposed to its aim of protecting against risks.

There are a few common insurance frauds, and they include, premium diversion, fee churning and asset diversion. Other types of insurance fraud include automobile collision, staged home fire, burglar, robbery and theft, stolen cars, employee-agent fraud, falsified claims, etc.

The perpetrators of insurance fraud can either be the claimants or the employees of the said Insurance company.

Common Schemes of Insurance Fraud

- Premium Diversion: This is the most common type of insurance fraud. Here, funds that businesses or individuals pay to an insurance provider is being embezzled. The policyholder is dutifully paying his/her premium without knowing that the insurance broker or agent is keeping the money for personal use and it is not being remitted to the underwriter or insurance company.

There are different types of insurance coverage in which premium diversion may occur and they include home insurance, automobile insurance, health insurance and workers compensation.

- Fee Churning: This is one of the hardest insurance frauds to detect. In this case, an insurance broker or agent replaces a policyholder’s insurance for another without making changes to the coverage itself and without the knowledge of the policyholder. In another case of churning, the intermediaries take repeated commissions from the initial premium until there is nothing left to pay the claims to the policyholders.

An example of an insurance coverage where churning can occur is Life insurance.

- Asset Diversion: This is a complex form of insurance fraud that involves complicated financial transactions. This occurs when two insurance companies merge or where one insurance company acquires another insurance company and often use the acquired company’s assets to settle debts unlawfully.

Examples of insurance coverages where asset diversion can occur is health insurance, life insurance, home insurance and automobile insurance.

How to Protect Yourself

- Be sure that the insurance broker/agent and company are licensed

- Get a copy or certificate of the policy

- Insurance policy numbers should be kept a secret as fraudsters can steal the number and involve you in various schemes

- Be wary of unusually low premiums

- Beware of offers that ask for insurance coverage to be upgraded

- If the investment seems too good to be true, steer clear of it.

Written by: Oreoluwa Adegoke, CFE